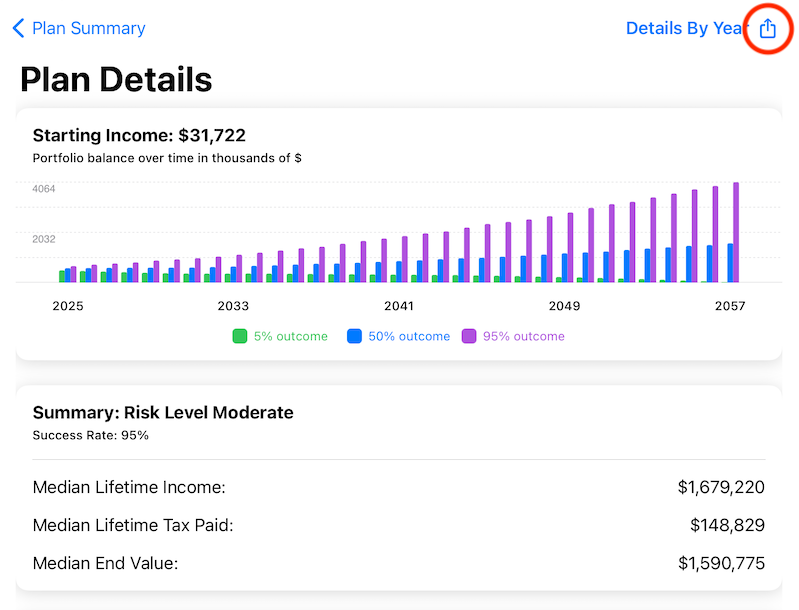

Bonfire Retirement Planner is the leading retirement planning tool for iPad and iPhone. We help you find your optimal retirement income based on your needs and risk tolerance. Many people may have a rough idea of their expenses but aren't sure how much they should spend in retirement. This can lead to spending far too much and risking running out of money early in retirement, or spending far too little, and sacrificing their quality of life out of fear.

Bonfire Planner helps to show you what is possible based on your savings, investments, and other sources of income such as pensions and Social Security. And our tax planning features help to ensure that your portfolio withdrawals are done in the most tax-efficient way possible.

After launching in mid-2020 we are now on our twelfth planner release (1.0.11). Here is a rundown of some recent changes:

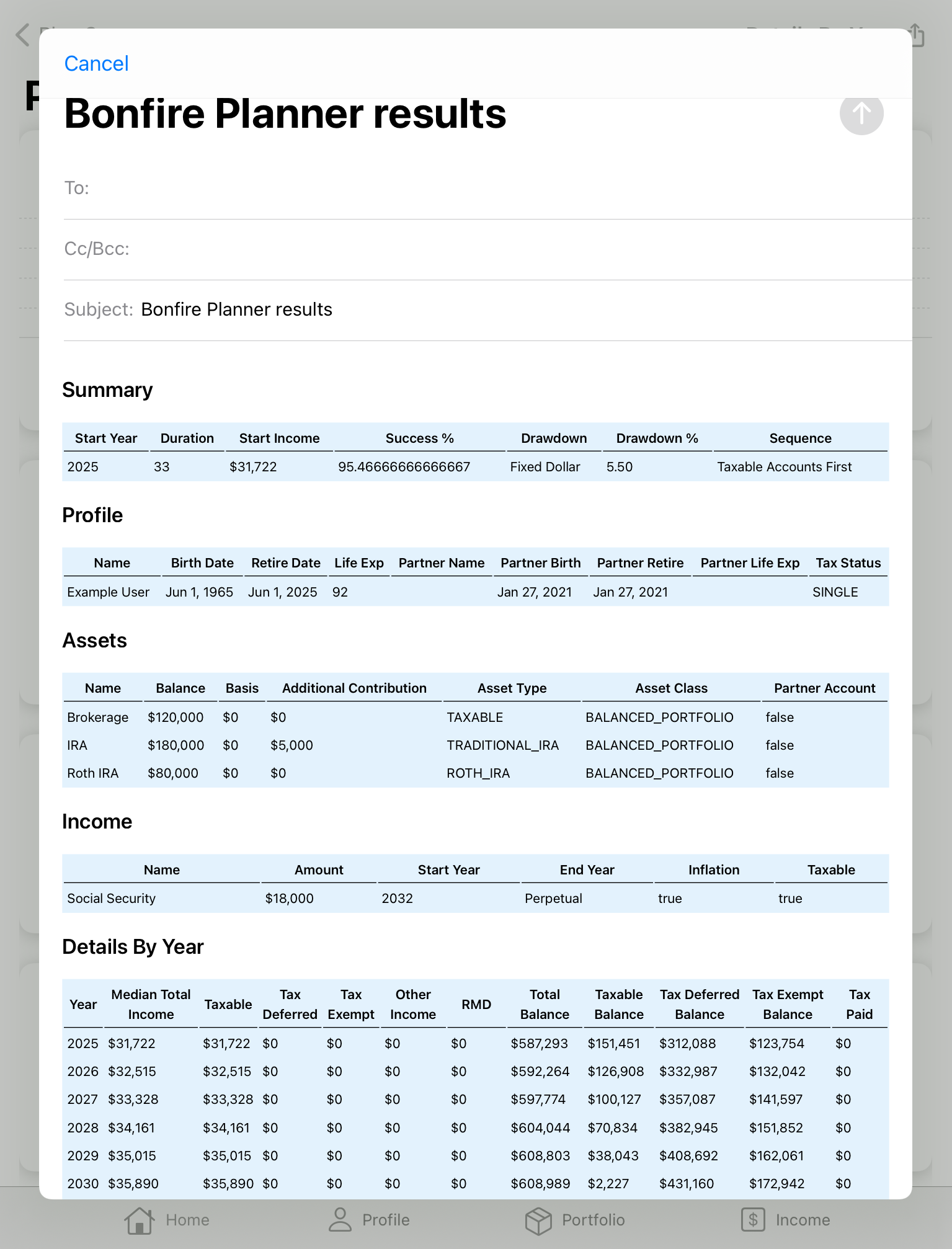

Retirement Data Email Export

This has been one of our most requested features, and we listened. Beginning in version 1.0.10 [paid version], you can export your data from the retirement planner by email, which makes it easy to share with others or import into another application. The email includes all of your profile, asset, and income data, as well as the details of the selected retirement plan.

Additional Planner Options

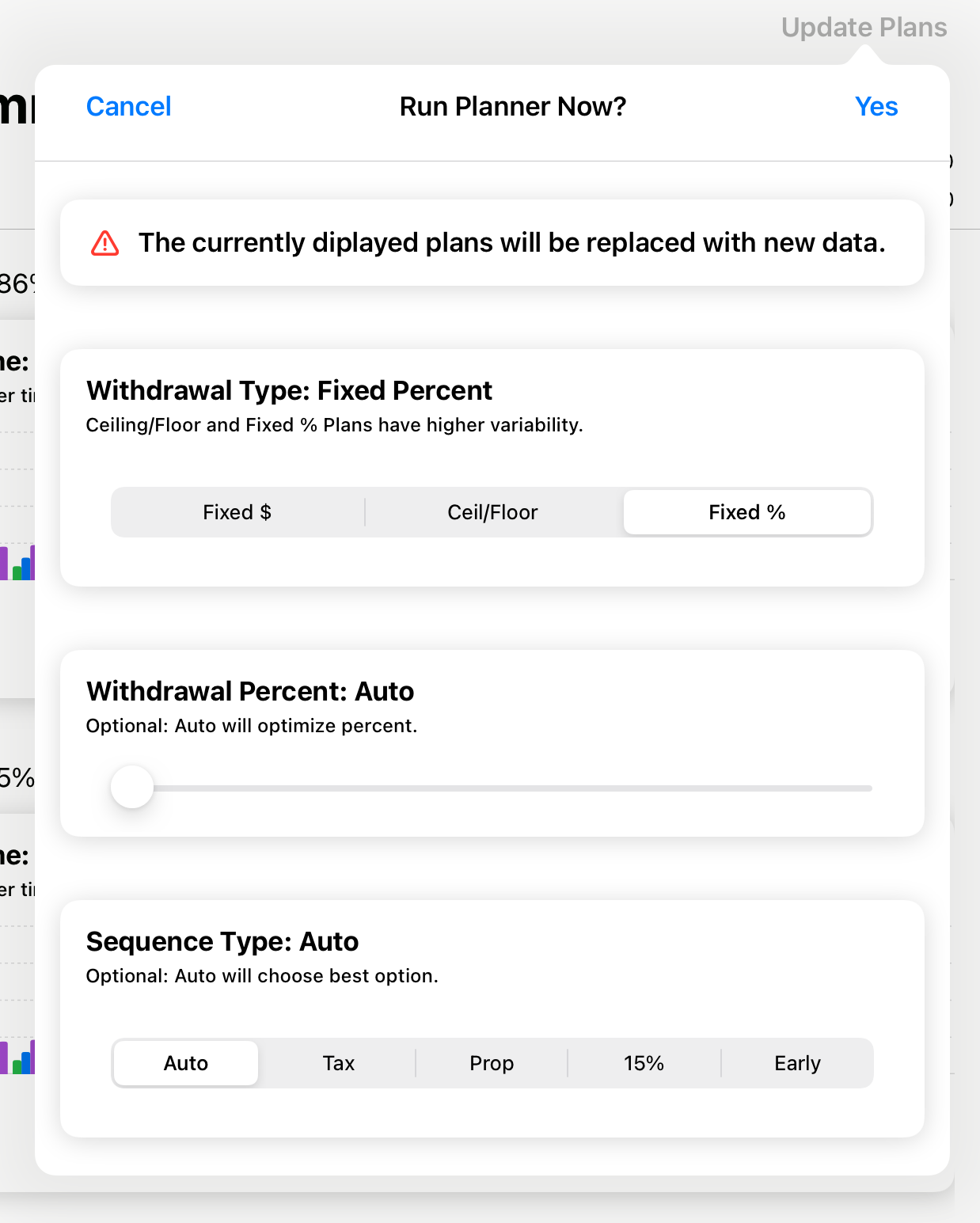

Beginning in version 1.0.11 [paid version], we've expanded the options you have when running the planner. These expanded choices will give you more control and should also make it more clear which options the planner is evaluating.

Choose Your Preferred Withdrawal Strategy

The three main withdrawal strategies are 'Fixed Dollar', 'Ceiling/Floor', and 'Fixed Percent'. This is the only planner option you are required to enter as it has a material impact on how much your income will vary.

Fixed Dollar is the most stable, as you will withdraw an inflation-adjusted amount from your portfolio each year regardless of market conditions. Fixed Percent is the most variable and your income will fluctuate with market conditions. Ceiling/Floor is similar to Fixed Percent but uses guardrails to prevent your income from fluctuating too much in any single year.

Choose Your Exact Withdrawal Percentage

When set to 'auto', which is the default behavior, the planner will evaluate many percentage options (in quarter-percent increments) to find the best options based on risk level.

However, there are times when you might want to check a specific percentage. For example, if the planner initially shows a moderate-risk plan at 3.25% and an aggressive-risk plan at 4.25%, you might want to fine-tune your income and manually check the plan with a 3.75% withdrawal percentage.

Choose Your Preferred Tax Strategy

Sequence options determine the order in which funds are withdrawn from your accounts. How funds are withdrawn from taxable (e.g. normal savings and brokerage accounts), tax-deferred (e.g. 401k and Traditional IRA accounts), and tax-exempt (e.g. Roth IRA and 401k) accounts can have a significant impact on your tax bill.

Bonfire Retirement Planner evaluates four different strategies to find the most tax-efficient option. Similar to the percentage option, when set to 'auto' the planner will evaluate each option and select the most tax-efficient choice.

| Option | Tax Strategy |

|---|---|

| Tax | Taxable accounts first, then tax-deferred, tax-exempt last. This is a common choice but may lead to significant tax bills when Required Minimum Distributions (RMDs) are required from tax-deferred accounts. |

| Prop | Proportional withdrawals. Withdraw from each account type proportionally. |

| 15% | Fill lower tax brackets. This strategy will make sure you are taking advantage of lower tax brackets if they are available. |

| Early | Start tax-deferred withdrawals at age 65. This may help reduce the tax impact of RMDs by starting withdrawals from tax-deferred accounts sooner than needed. |

What's Next for Bonfire Retirement Planner?

Roth IRA Conversions

We'd like to make it easy to include testing Roth IRA conversions in your plan.

Web Version

While iPad and iPhone provide a great platform for privacy, security, and ease of use, we recognize that not everyone has one. We'd like to make Bonfire Retirement Planner available to anyone with a web browser.

Financial Advisor Referrals

While Bonfire Retirement Planner was initially created to provide pro-quality financial planning tools to individual consumers, we also recognize that many people want to review their plans and get additional financial help from a certified financial planner. We'd like to help make that as easy as possible!

We Want to Hear From You!

As always, we appreciate our users and are always happy to hear from them. Your feedback can help make Bonfire Retirement Planner a better product.

If you can, please take a minute and provide us feedback through our survey: Take the Survey!

- Scott

Notes: